gnipart.ru

Community

How To Make A Small Business Loan

Financial institutions provide commercial loans for most types of business. Government loans come from funding programs with specific rules about who can get a. The U.S. Small Business Administration (SBA) helps small businesses get funding by setting guidelines for loans and reducing lender risk. Research the lender in advance and keep in mind there are typically no up-front application fees for a business loan. Understanding your credit score. Yes, there are different types of Small Business Administration loans, but all require a core set of documents. Here's how you can apply to get a loan via. Learn from the Small Business Administration (SBA) about how to start and fund a small business, from researching the market to launching your new business. For the best chances of getting your business loan application approved, follow these steps: 1. Research lenders to discover the best ones for your business. Borrow up to $,, or as little as you need, and have the cash in your bank account in as little as 24 hours. Express Funding avaliable up to $20, Sources of small business funding ; Business loans from yourself, friends or family. Insight on keeping your business funding source close to home. ; Getting a. Canada Small Business Financing Loan (CSBFL) · Here's what you get · Government loan requirements for a CSBFL · You might also be interested in: · We're ready to. Financial institutions provide commercial loans for most types of business. Government loans come from funding programs with specific rules about who can get a. The U.S. Small Business Administration (SBA) helps small businesses get funding by setting guidelines for loans and reducing lender risk. Research the lender in advance and keep in mind there are typically no up-front application fees for a business loan. Understanding your credit score. Yes, there are different types of Small Business Administration loans, but all require a core set of documents. Here's how you can apply to get a loan via. Learn from the Small Business Administration (SBA) about how to start and fund a small business, from researching the market to launching your new business. For the best chances of getting your business loan application approved, follow these steps: 1. Research lenders to discover the best ones for your business. Borrow up to $,, or as little as you need, and have the cash in your bank account in as little as 24 hours. Express Funding avaliable up to $20, Sources of small business funding ; Business loans from yourself, friends or family. Insight on keeping your business funding source close to home. ; Getting a. Canada Small Business Financing Loan (CSBFL) · Here's what you get · Government loan requirements for a CSBFL · You might also be interested in: · We're ready to.

What is required for a small business loan? · Number of years in business: Some lenders may have tenure requirements to meet before you can apply or be approved. CNBC Select spoke to financial expert Ashley Russo to breakdown when it may (and may not) be beneficial to take out a personal loan to start your small. Fund your business yourself with self-funding. Otherwise known as bootstrapping, self-funding lets you leverage your own financial resources to support your. According to the SBA, its Microloan program provides small businesses with small, short-term loans — up to $50, — for working capital, or to buy inventory. Guaranteed by the government, the Canada Small Business Financing Loan (CSBFL) provides financing to start a business or grow an existing one. Banks. A traditional source for small business loans, brick-and-mortar banks and credit unions are a good option for borrowers with excellent credit in need. SBA loans are based on a cash flow analysis and require less of a down payment. This allows a borrower to get started with less money down and opens the doors. Do you qualify? · Must have atleast 12 months in business · Your business must generate $50, or more in annual sales · You must own at least 20% of the business. A small business loan is a type of loan that business owners can apply for and receive for the purpose of supporting their payroll, inventory, and other. Typical documents required to initiate your loan application include: · Several months of bank statements · Outstanding credit account statements (if hard credit. When you're ready to borrow funds, book a meeting with one of our business advisors. You'll increase your chances of getting approved if you have a good credit. Send us a message to learn more or get started with a new small business loan or line of credit. Send Message. Term Loans and Lines of Credit. Orange line. You can apply for a Business Advantage Auto Loan online · If you use Small Business Online Banking, you can apply for an unsecured business loan or unsecured. Where Do I Begin if I Need a Business Loan for a Startup? · 1. Small Business Administration (SBA) Loans. The Small Business Administration (SBA) has various. Sometimes lenders require collateral to guarantee small business loans. Typically, the borrower pays back the loan in installments over a designated period of. Small business loans from National Funding have $0 upfront costs and fast approval within 24 hours. Get up to $k in small business financing. Apply now! This article can't guarantee that you will get approved, but it can help you prepare for your initial meeting with a lender. Small Business Administration (SBA) Loans · The SBA helps small businesses get SBA loans by supporting them up to a certain loan amount. · Make payments easier. Most banks offer a few types of financing options for small businesses, including term loans, lines of credit, US Small Business Administration, or SBA loans. This includes using personal funds, finding investors, or taking out loans. The SBA also has funding for groups such as: Women-owned businesses · Minority-owned.

Individual Supplemental Dental Insurance

If you have dental insurance but want to reduce costs, CarePlus supplemental dental insurance can save you up to 30% for full coverage dental insurance. Employers with 51 or more eligible employees can build a customized dental plan using our three network choices, flexible benefit designs, and optional coverage. Explore supplemental insurance plans for individuals and families, like dental or vision insurance, to help you plan ahead for life's unexpected events. Find individual and family dental plans to fit your needs and budget. Buy an individual dental insurance plan directly from Delta Dental. Individual dental insurance plans ; Classic Plan. Economical coverage, with cost-sharing on all covered services with a monthly contract · $ ; Clear Plan. No. Choose from up to four dental plans to get the right coverage for you and/or your family. The dental plans offer coverage for services such as cleanings. Supplemental dental insurance is a separate dental plan with an additional premium that can be paired with a Medicare Advantage plan or a primary dental plan. Many people find value in buying dental coverage apart from their medical plan because separate plans usually offer more choices and may have better benefits to. The Best Supplemental Dental Insurance on the Marketplace · 1. Denali Dental · 2. Delta Dental · 4. Renaissance Dental · 5. California Dental. An affordable option. If you have dental insurance but want to reduce costs, CarePlus supplemental dental insurance can save you up to 30% for full coverage dental insurance. Employers with 51 or more eligible employees can build a customized dental plan using our three network choices, flexible benefit designs, and optional coverage. Explore supplemental insurance plans for individuals and families, like dental or vision insurance, to help you plan ahead for life's unexpected events. Find individual and family dental plans to fit your needs and budget. Buy an individual dental insurance plan directly from Delta Dental. Individual dental insurance plans ; Classic Plan. Economical coverage, with cost-sharing on all covered services with a monthly contract · $ ; Clear Plan. No. Choose from up to four dental plans to get the right coverage for you and/or your family. The dental plans offer coverage for services such as cleanings. Supplemental dental insurance is a separate dental plan with an additional premium that can be paired with a Medicare Advantage plan or a primary dental plan. Many people find value in buying dental coverage apart from their medical plan because separate plans usually offer more choices and may have better benefits to. The Best Supplemental Dental Insurance on the Marketplace · 1. Denali Dental · 2. Delta Dental · 4. Renaissance Dental · 5. California Dental. An affordable option.

In the Marketplace, you can pick a health plan with or without dental benefits. If you pick a health plan without dental benefits, you can still get a separate. Dental savings plan Our dental savings plan is different from insurance. It gives plan members access to discounted pricing on many types of dental procedures. Many people find value in buying dental coverage apart from their medical plan because separate plans usually offer more choices and may have better benefits to. With HealthPartners, you can get medical and dental insurance all in one place, meaning fewer companies to navigate and one online account. Plus, it's all. Choose from our plans that include basic dental coverage for general dental care — or explore coverage that includes major dental care, such as dental implants. This means you have immediate coverage for routine services like exams and cleanings, plus procedures like crowns and root canals More choice in plans and. Discover affordable dental insurance plans at Delta Dental. Get coverage for preventive, basic, and major dental services. Protect your smile today! Delta Dental offers a range of plans for individuals and families, so you can get the same valuable dental benefits that employers offer — including access to. Find individual and family dental plans to fit your needs and budget. Buy an individual dental insurance plan directly from Delta Dental. $$ deductibles · Up to $2, in dental benefits · Up to $ in vision benefits · Up to $ in hearing benefits · Dental implants available on select plans. Dental Insurance Highlights · Deductible that decreases over time. Policy year 1: $75/person. Policy year 2: $50/person. · No waiting period for preventive dental. Shop affordable individual & group dental insurance plans from America's largest and most trusted dental insurance carrier. At Delta Dental, we offer a wide variety of affordable individual dental insurance plan options. Explore our PPO, Dental HMO, managed, and discount dental plans. Full coverage dental insurance includes plans that help cover you for preventive care, as well as basic and major restorative care, and in some cases. Supplemental dental insurance acts as a valuable ally in managing the costs of dental care beyond what your primary dental plan covers. For instance, some plans have a separate annual maximum for certain services, like dental implants or orthodontia. Depending on the plan, cost coverage may. PPO plans provide benefits for a broad range of covered services/procedures, giving you the flexibility to choose any licensed dentist, in or out-of-network. A healthy mouth benefits the whole body, so it's important to find the right dental insurance plan. Learn more about Aetna's individual and family dental. Supplemental dental insurance aims to bridge the gap where a primary dental insurance plan fails to cover care. These plans can cover implants, dentures or.

Who Does Loans On Taxes

Tax forms are not issued for student loan disbursements. See Repayment Chapter – Tax Credit on Interest Paid section for information about tax credits for loans. How and when compulsory repayments of your study and training support loan are made through the income tax system. Voluntary repayments. You can make voluntary. By filing taxes with H&R Block, receive a same-day tax advance up to $ Save with H&R Block's Refund Advance offering, with no interest & loan fees. Complete th e Student Loan Debt Relief Tax Credit Application. The appli cation will be open thro ugh September 15, One of the most effective strategies in a low interest rate environment is through a loan directly to family members or, where minors are involved, to a family. (1) "Borrower" means a taxpayer who receives the proceeds of a refund anticipation loan. (2) "Department" means the department of financial institutions. (3) ". Your lender – that's your tax preparer – will give you the funds as a check, a prepaid debit card or a direct deposit into your bank account. This is a product that provides you with part of an expected tax refund faster than the IRS can send the money. If you receive loans or grants, you may be sent forms for your taxes. Tax receipts are issued to students who paid interest on a student loan. The. Tax forms are not issued for student loan disbursements. See Repayment Chapter – Tax Credit on Interest Paid section for information about tax credits for loans. How and when compulsory repayments of your study and training support loan are made through the income tax system. Voluntary repayments. You can make voluntary. By filing taxes with H&R Block, receive a same-day tax advance up to $ Save with H&R Block's Refund Advance offering, with no interest & loan fees. Complete th e Student Loan Debt Relief Tax Credit Application. The appli cation will be open thro ugh September 15, One of the most effective strategies in a low interest rate environment is through a loan directly to family members or, where minors are involved, to a family. (1) "Borrower" means a taxpayer who receives the proceeds of a refund anticipation loan. (2) "Department" means the department of financial institutions. (3) ". Your lender – that's your tax preparer – will give you the funds as a check, a prepaid debit card or a direct deposit into your bank account. This is a product that provides you with part of an expected tax refund faster than the IRS can send the money. If you receive loans or grants, you may be sent forms for your taxes. Tax receipts are issued to students who paid interest on a student loan. The.

(3) "Lender" means a person who extends credit to a borrower in the form of a refund anticipation loan. (4) "Refund anticipation loan" means a loan borrowed by. (1) "Borrower" means a taxpayer who receives the proceeds of a refund anticipation loan. (2) "Department" means the department of financial institutions. (3) ". If you do not repay your loans · your tax refunds and/or GST and HST credits may be withheld and applied toward your outstanding student loan debt · you will not. Is a tax loan just for paying taxes? As its name suggests, the main purpose of a tax loan is to pay taxes. In earlier times, some banks even paid tax bills. Tax refund loans are available to taxpayers who've filed a federal income tax return and are eligible for a refund. Refund Advantage offers tax office business loans to prepare for tax season. Loans are not taxable distributions unless they fail to satisfy the plan loan rules of the regulations with respect to amount, duration and repayment terms, as. Many tax preparers offer a refund anticipation loan (RAL) if you want your refund right away. The tax preparer will give you your refund within a day or two of. All corporations doing business and having fiscal officers in Pennsylvania are subject to corporate loans tax, imposed at the rate of 4 mills on each dollar. RALs and RACs are essentially high-interest loans which must be repaid by your actual tax return. Do not pay to borrow your own money. If your tax return is. Fact – If eligible, you can apply for a Refund Advance loan at the end of your tax prep. Pathward® N.A., the lender for the loan will notify all applicants by. Personal loans are not considered income and cannot be taxed unless the loan is forgiven. $ Bonu$ – also referred to as Free Tax Loan – is an optional tax refund The amount of the advance - $ to $ - will be deducted from tax refunds and. While RALs are no longer issued by banks, some lower-income taxpayers will remain vulnerable at tax time. Some tax preparers seek out other lending sources. Fast Cash Advance is an optional tax-refund related loan provided by First Century Bank, NA, Member FDIC (it is not the actual tax refund) and is available at. Key Takeaways · Interest paid on personal loans, car loans, and credit cards is generally not tax-deductible. · However, you may be able to claim the interest. "Borrower" means an applicant who receives a refund anticipation loan through a facilitator. "Customer" means an individual for whom tax preparation services. Accountant-prepared year-end financial statements are usually needed to apply for larger business loans. A bank may also ask for interim statements prepared. But to get these loans, you must pay to file your taxes. This is unnecessary since the loan doesn't provide your tax refund quicker, and you can get your taxes. Refund anticipation loan (RAL) is a short-term consumer loan in the United States provided by a third party against an expected tax refund for the duration.

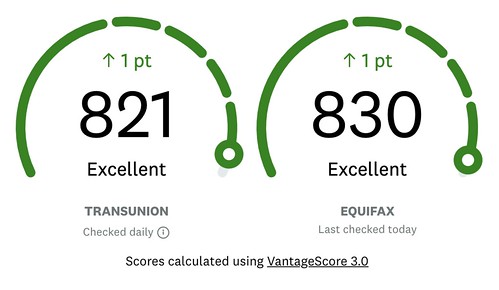

What Is Vantage Score Mean

VantageScore® Improve delinquency predictiveness while expanding your lending universe with the first tri-bureau credit scoring model using trended credit. A FICO Score is a three-digit number based on the information in your credit reports. It helps lenders determine how likely you are to repay a loan. VantageScore is a consumer credit-scoring system in the United States, created through a joint venture of the three major credit bureaus. A credit score is a number that provides a comparative estimate of an individual's creditworthiness based on an analysis of their credit report. A FICO Score is a three-digit number based on the information in your credit reports. It helps lenders determine how likely you are to repay a loan. Many people know that a credit score is a number, but they don't know what that number means. Credit scores are numbers calculated based on information in your. VantageScore is a leading credit-score model development company that generates the most inclusive, innovative and predictive models used in the consumer-credit. The scoring seems counterintuitive for consumers accustomed to the FICO system. In Experian's system a score of means a 10% chance that at least one account. FICO Scores have been an industry standard in helping lenders and creditors evaluate their customers' latest version of their credit profile to know if they are. VantageScore® Improve delinquency predictiveness while expanding your lending universe with the first tri-bureau credit scoring model using trended credit. A FICO Score is a three-digit number based on the information in your credit reports. It helps lenders determine how likely you are to repay a loan. VantageScore is a consumer credit-scoring system in the United States, created through a joint venture of the three major credit bureaus. A credit score is a number that provides a comparative estimate of an individual's creditworthiness based on an analysis of their credit report. A FICO Score is a three-digit number based on the information in your credit reports. It helps lenders determine how likely you are to repay a loan. Many people know that a credit score is a number, but they don't know what that number means. Credit scores are numbers calculated based on information in your. VantageScore is a leading credit-score model development company that generates the most inclusive, innovative and predictive models used in the consumer-credit. The scoring seems counterintuitive for consumers accustomed to the FICO system. In Experian's system a score of means a 10% chance that at least one account. FICO Scores have been an industry standard in helping lenders and creditors evaluate their customers' latest version of their credit profile to know if they are.

The ability to analyze at least two years' worth of consumer credit file data means the VantageScore model can generate credit scores for consumers with. FICO® Score Scale: Though typically considered to be above average, the “good” category under the FICO model actually contains the average FICO Score. A Vantage score is formulated by the credit bureaus themselves (not by Fair Isaac), based upon a different algorithm. As of this date, very few. Achieving a credit score of officially places you in the good credit score category, although it does fall slightly below the average. VantageScore is the first and only tri-bureau credit scoring model to incorporate trended credit data and advanced machine learning for deeper risk. Generally, a score between and means you have bad credit, to means you have fair credit, to is good credit, and up is excellent. Currently, the FICO score is known as the dominant credit score used by lenders, but this will soon change. Vantage is being touted as a better model. Both VantageScore and FICO scores span from a low of to a high of They are then split into ranges, based on how low your credit score is to how high. VantageScore is another leading credit score model used by many financial institutions and lenders. VantageScore and follow the to range, but. A credit score in the range of to means the borrower is consistently responsible when it comes to managing their borrowing. Credit scores typically fall in one of the credit score ranges that determine if your credit is excellent, good, fair or poor. Learn how to take your score. Credit scores have a major impact on our financial lives. Lenders and other organizations rely on these numerical “grades” to make objective and accurate. A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. VantageScore is a credit rating service that caters directly to individual consumers. It is a credit rating product that was jointly developed by three credit. FICO® Scores are the standard for credit scores—used by 90% of top lenders. Credit scores influence the credit that's available to a person and the terms . Credit scores are a quick assessment of a borrower's track record on paying bills, and help lenders gauge how trustworthy a borrower will be at repaying money. FICO score analyzes a person's financial history to derive a number showing that person's credit worthiness. The Fair Isaac Corporation introduced the formula. What Do Your Reason Codes Mean? Subscribe to Our Newsletter to Stay on Top of Credit Scoring News! VantageScore is a leading credit-score model development. The VantageScore is more well known than VantageScore The version puts more emphasis on payment history and new credit, and puts less weight on. The FICO® score is a proprietary credit scoring methodology developed by the Fair Isaac Corporation. The VantageScore credit score was developed by the three.

Best Places To Get A Loan For A House

The Federal Housing Administration (FHA) makes it easier for consumers to obtain affordable SSA BEST Questionnaire · gnipart.ru Federal. Keep up with Canadian Mortgage Trends by following us on our social media channels such as Facebook, X and LinkedIn. Shop around, don't just go to the big banks. Check out local credit unions and mortgage brokers. For mortgage brokers: gnipart.ru View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you. Prequalify or apply for your mortgage in minutes. Ontario Mortgage Rates. Looking for the best mortgage rates in Ontario? A place to grow your mortgage savings — with your very best mortgage rate? Specifically, the VA home loan, for veterans and active duty members of the U.S. military, is by far the best loan on the planet. It does not. With a MoneyGeek score of 98, First Tech is the best place to get a personal loan in New York, providing excellent customer service, competitive interest. The Federal Housing Administration (FHA) makes it easier for consumers to obtain affordable SSA BEST Questionnaire · gnipart.ru Federal. Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination fees. · Veterans United. The Federal Housing Administration (FHA) makes it easier for consumers to obtain affordable SSA BEST Questionnaire · gnipart.ru Federal. Keep up with Canadian Mortgage Trends by following us on our social media channels such as Facebook, X and LinkedIn. Shop around, don't just go to the big banks. Check out local credit unions and mortgage brokers. For mortgage brokers: gnipart.ru View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you. Prequalify or apply for your mortgage in minutes. Ontario Mortgage Rates. Looking for the best mortgage rates in Ontario? A place to grow your mortgage savings — with your very best mortgage rate? Specifically, the VA home loan, for veterans and active duty members of the U.S. military, is by far the best loan on the planet. It does not. With a MoneyGeek score of 98, First Tech is the best place to get a personal loan in New York, providing excellent customer service, competitive interest. The Federal Housing Administration (FHA) makes it easier for consumers to obtain affordable SSA BEST Questionnaire · gnipart.ru Federal. Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination fees. · Veterans United.

Shop for a loan, not a lender. You may have a long-term relationship with your bank, but that doesn't mean they will give you the best deal. Most loans are sold. MaineHousing's First Home Loan Program makes it easier and more affordable to buy a home of your own by providing low fixed interest rate mortgages. Our network of private lenders and private mortgage companies can lend on real estate in every city and town in Ontario. To get the best interest rate for a. get the best mortgage rate in Ontario. 61% of first-time homebuyers consulted with a mortgage broker, while 39% obtained a mortgage through their mortgage. 1. Prime Case Funding. (27 reviews). Check Cashing/Pay-day Loans. mi · 2. New York Payday Loan Solutions. (1 review). Check Cashing/Pay-day Loans. Dominion Lending Centres is Canada's leading mortgage company with mortgage professionals under our umbrella across the country! Wells Fargo Home Mortgage offers competitive rates on a variety of home loan options. Visit Wells Fargo today to check rates and get mortgage financing. Why is this the best alternative/private mortgage for me and my family? Is it the most affordable one? If not, what features make it more suitable for my. Best for Small Amounts: Upgrade · Affordable loans from $10, - $50, with low fixed rates that will never change, affordable monthly payments, and no. Choosing the best investment property loan can help maximize your returns. We researched 38 lenders to reveal the top investment property loans available. Shop for a loan, not a lender. You may have a long-term relationship with your bank, but that doesn't mean they will give you the best deal. Most loans are sold. JD MORTGAGE® connects you with lenders who want to help you get the funds you need. We find the lenders that offer terms specially tailored to your goals—for. Home. Get A Loan · Find An Advisor. Setting You Up for a Awards and Recognitions. Top 10 Mortgage Company · Great Place to Work Certified · Great Places. The MI Home Loan program is a mortgage product that is available to first-time homebuyers state-wide and repeat homebuyers in targeted areas. mortgage loan. Step 2: After receiving pre-approval from a participating lender, consult a reputable real estate professional to identify an affordable home. top mortgage brokers, instantly, all in one place. Shopping around is critical How do I get the best mortgage rate in Ontario? As home to Canada's. This calculator factors in your total earnings and debts to give you a maximum affordable monthly housing cost, including mortgage payment, property taxes. Looking for a lender? · JPMorgan Chase Bank, National AssociationNMLS# · Homestead Funding gnipart.ru# · Contour Mortgage CorporationNMLS# The links here provide access to areas within our USDA Eligibility Site For the Single Family Housing Direct Home Loan Program, the Home Repair Loan.